This time around it’s Tariffs and the US initiated Global Trade War – the last time we saw this was just over 3yrs ago (Feb 24th 2022 to be exact) and the headline news was centred on the Russia / Ukraine conflict erupting and Equity Markets selling-off. The headline news today is different but could have been avoided if only someone had listened to the smartest people in the room.

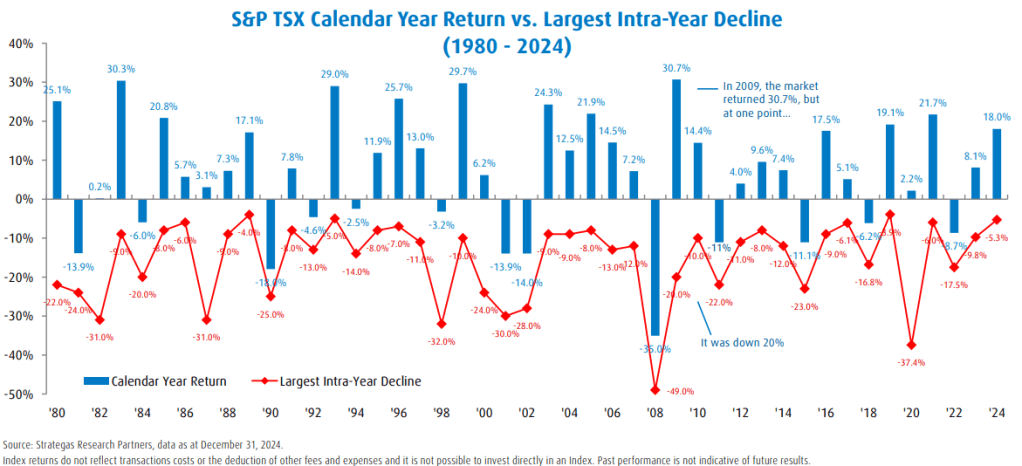

As a result, you’re more likely a little nervous and need some handholding over the next few hours, days, weeks….. But the reality is we have been here before… See graph below

Each and every time there was a downturn in the market the markets have stormed back with a significant gain. Will it take time probably as we have never seen someone ever want to sabotage the market in this way. Once the storm is over and we pick up the pieces the process will be the same.

So if you have been thinking “Should I sell everything”, now might be a good time for a quick reminder on how you interpret losses relative to gains, and how losses are magnified by 2-3x that of gains. This concept is known as Loss Aversion Theory, loss aversion is a cognitive bias that suggests that for individuals the pain of losing is psychologically twice as powerful as the pleasure of gaining.

Having this in mind, if you are nervous, understanding emotions and how you are receiving and responding to market volatility when looking at the value of you portfolios is critical. People don’t often think about their portfolios from a fundamental perspective (that’s why you need –the voice of reason – for you to make the right decisions for the right reasons and most importantly remove emotions from your decision making process). Stay with the process you don’t lose anything unless you sell and understand that the world will rebound and we all move forward.

Leave a comment